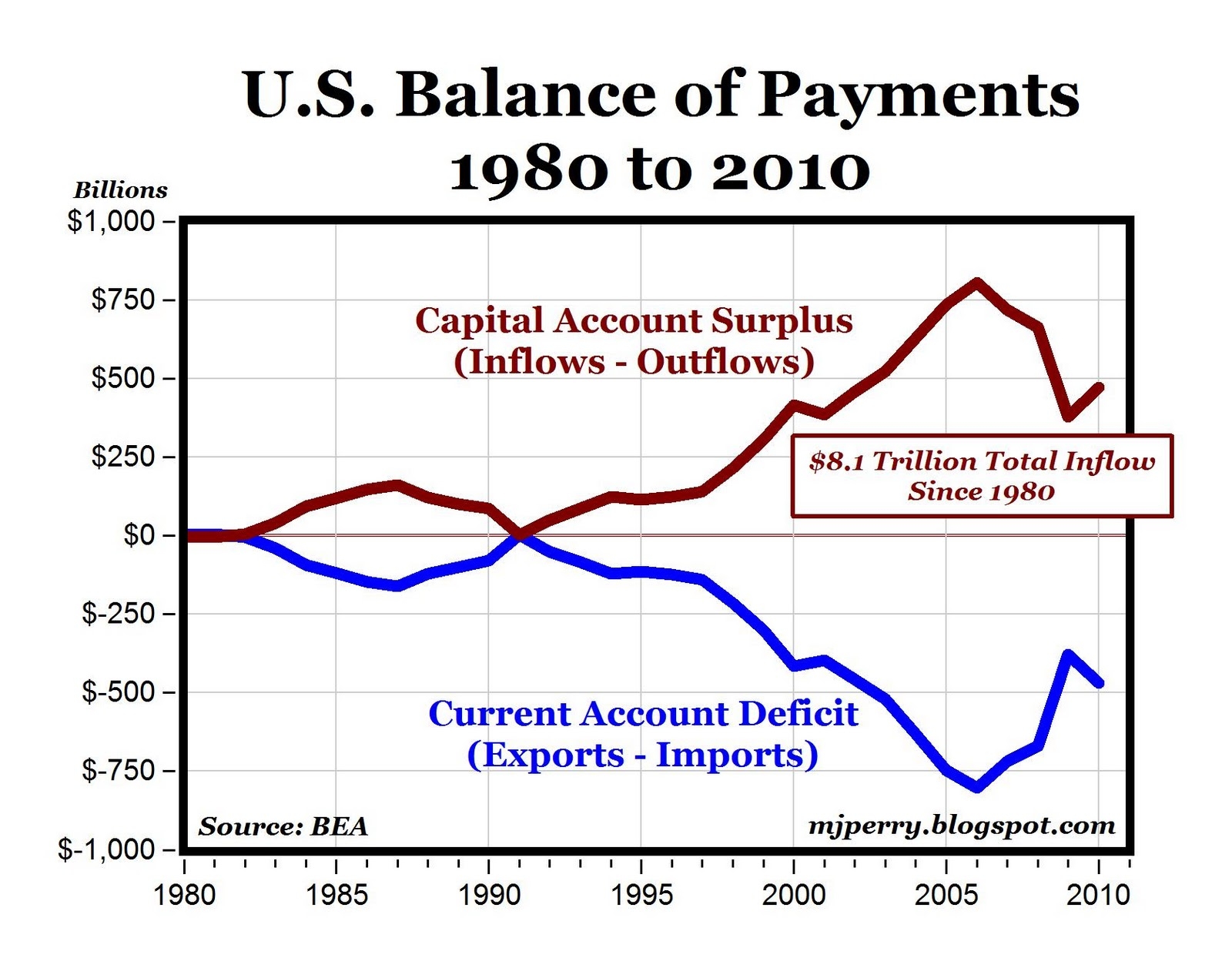

Here's a look at the balance of payments data back to 1980 (BEA data here), demonstrating graphically Don Boudreaux's statement that (under the creation that is Bretton Woods 2) "another name for a trade deficit” is a "capital-account surplus” – that is, inflows of investment funds into America or where ever that supply (directly or indirectly) financing for more of something. In the US's case, vendor financed consumption and government waste on a mass scale.

As a direct consequence of the current account deficits, the U.S. economy has been the beneficiary (only a benefit if it invested productively)of more than $8 trillion worth of capital inflows from foreigners since 1980. Because the Balance of Payment accounts are based on double-entry bookkeeping, the annual current account and capital account have to net to zero, so that any current account (trade) deficit (surplus) is offset one-to-one by a capital account surplus (deficit) and the balance of payments therefore always nets out to (equals) zero. And that's why it's called the "balance" of payments, because once we account for trade flows and capital flows, everything balances, and there are no deficits or surpluses on a net basis.

Now I am going to simplify some things and make a chart of South East Asia's balance of payments from say 1985 to 2001 that will capture the Asian financial crisis and the end result. Not all countries actually came to a full balance of payments but enough equilibrium was met to start a recovery, generally speaking. When I said simply, I meant simplify.... Click to enlarge it.

A boom is a boom, they all take the same shape, they all look the same. More on that later... But there is a big burden that the boom in the US carries that Asia didn't. Legacy government entitlement spending. Compared to the US, in SE Asia, there is no social security, there is no medicare or medicade. There is no life insurance, there is no pension ponzi schemes. The majority of society literally lives within its means. The kids take care of their elderly parents. When the boom burst in Asia(the capital took flight), the people effected could go back to their debt free lifestyle in the villages. The agrarian way of living was still there to fall back on. All they had to lose was their property boom, not much else. They did actually manage to get some decent infrastructure out of the whole ordeal.

But in the US, it is a diffrent story. American people have more to lose then a property boom. They have their whole way of life to lose. The whole soceity literally lives beyhond its means because they have come to rely on government entitlement spending. Govt spending is the thin red line.

So when the capital takes flight, the people that live off government spending are still there, waiting to pick up their pension checks, their insurence checks, their food stamps, their welfare, their medical care, their everything. What can the Fed or the treasury do ? Let everyone starve ? They will be forced to print newly created dollars to cover the government liabilities. And that is the process of hyperinflation.

More on how booms look. This is the official chart of the balance of payments of Lithuania....

The economy of Lithuania was one of the fastest growing in the world last decade (1998–2008) as GDP growth rate was positive 9 years in a row. Since the year 2000 GDP has almost doubled with a growth rate of 77%.

One of the most important factors for substantial economic expansion was the accession to capital and trade between European states. On the other hand, rapid economic expansion has caused some imbalances in inflation and balance of payments. The current account deficit to GDP ratio in 2006–2008 was in double digits and reached its peak at threatening 18.8% in the first quarter of 2008. This was mostly influenced by rapid loan portfolio growth as Scandinavian banks provided cheap credits in Lithuania. The loans directly related to acquisition and development of real estate constituted around half of outstanding bank loans to the private sector.(Real estate strikes again...) Consumption was affected by credit expansion as well. This led to high inflation of goods and services, as well as trade deficit.

The global credit crunch which started in 2008 affected the real estate and retail sectors. The construction sector shrank by 46.8% during the first 3 quarters of 2009 and the slump in retail trade was almost 30%. GDP plunged by 15.7% in the first nine months of 2009.

There will only be one difference with the fate of the US, a date with hyperinflation.....